According to the OECD/INFE 2020 international survey of adult financial literacy, about half of the EU adult population does not have a good enough understanding of basic financial concepts. While the overall figures are low, the problem is more acute in some parts of society than others, with the most vulnerable disproportionately affected. Low-income groups, for instance, as well as women, young people, and older people tend to score lower than the rest of the population when it comes to financial knowledge (Read more about it here).

Being financially illiterate can lead to a number of pitfalls, such as being more likely to accumulate unsustainable debt burdens, either through poor spending decisions or a lack of long-term preparation. This, in turn, can lead to poor credit, bankruptcy, housing foreclosure, and other negative consequences.

Financial literacy can help protect individuals from becoming victims of financial fraud, a type of crime that is becoming more commonplace (Read more about this here).

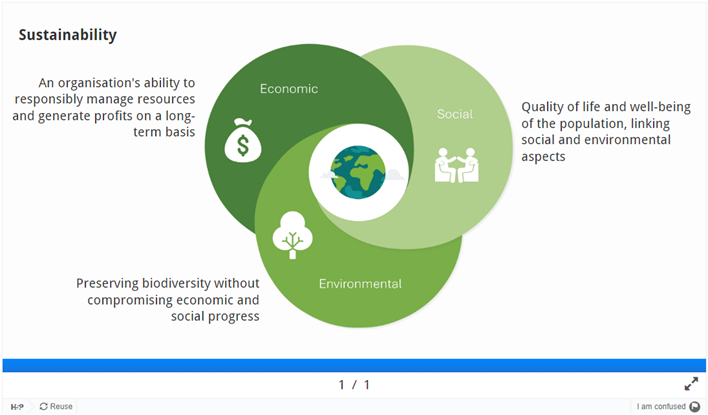

Although many skills might fall under the umbrella of financial literacy, popular examples include household budgeting, learning how to manage and pay off debts, and evaluating the tradeoffs between different credit and investment products. These skills often require at least a working knowledge of key financial concepts, such as compound interest and the time value of money.

Benefits of Financial Literacy:

- Financial literacy can prevent devastating mistakes

- Financial literacy prepares people for emergencies

- Financial literacy can help individuals reach their goals

- Financial literacy invokes confidence